Underrated Ideas Of Tips About How To Get Out Of Whole Life Insurance

Whole life insurance policies allow you to take out a loan or make a withdrawal from their accumulated value.

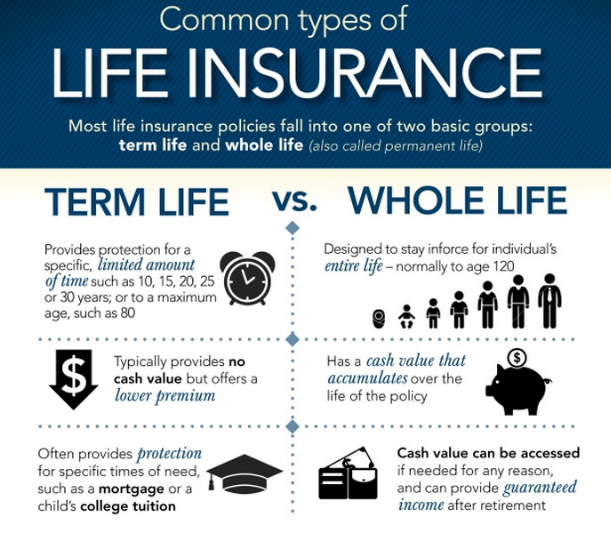

How to get out of whole life insurance. If you have a policy with a cash value component, you can borrow money from your life insurance. Different types of term insurance calculators are usually based on the plans given below: Before you do, read to.

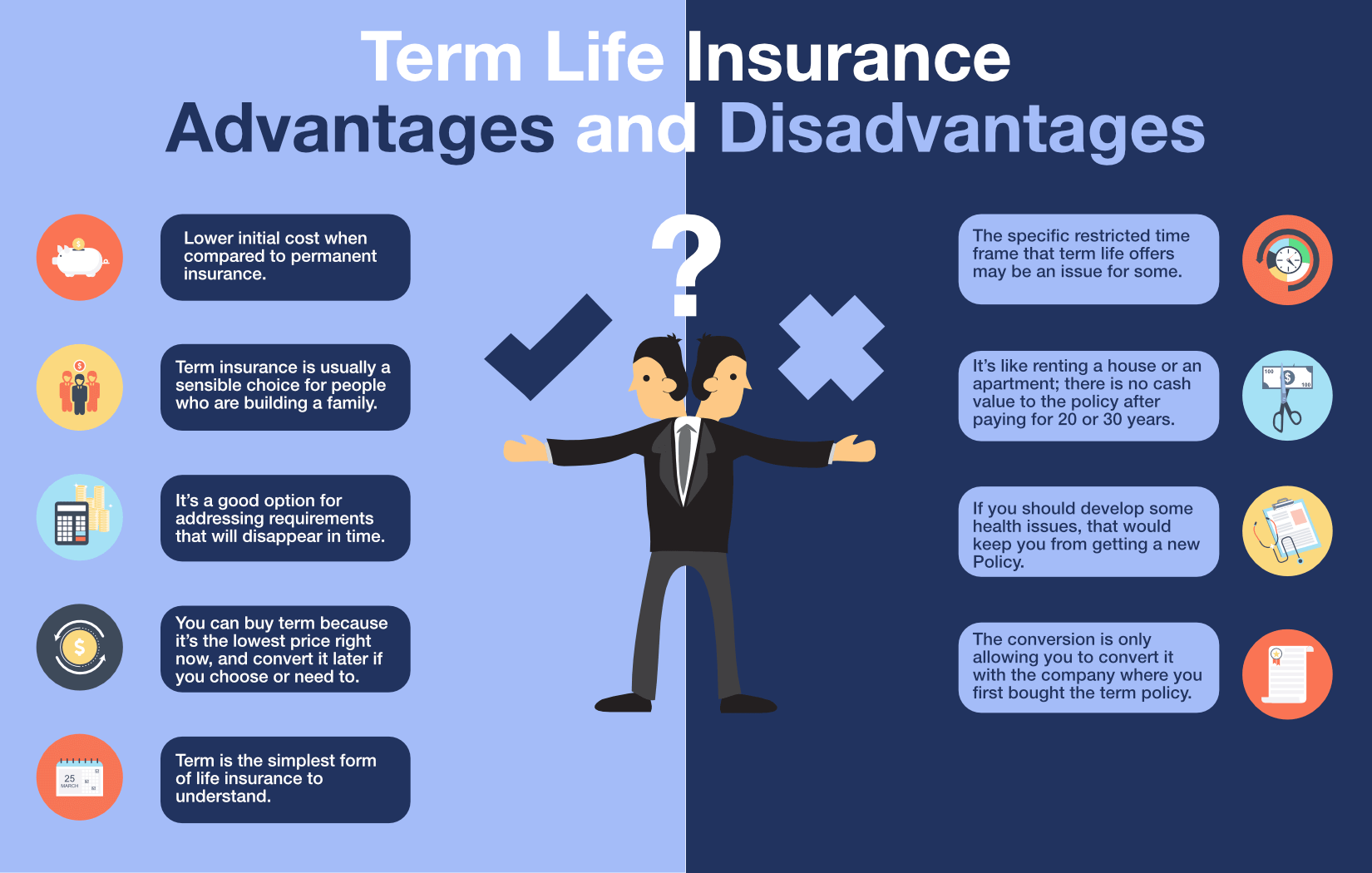

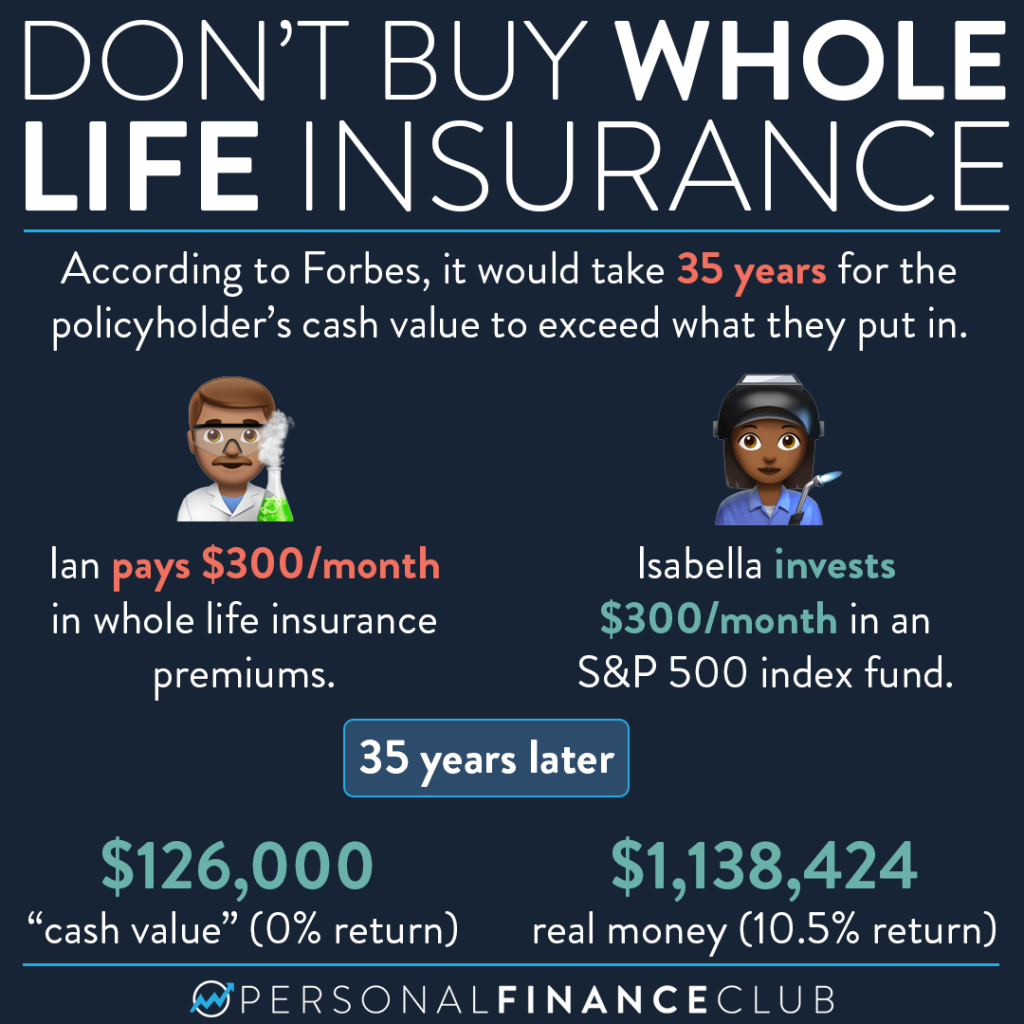

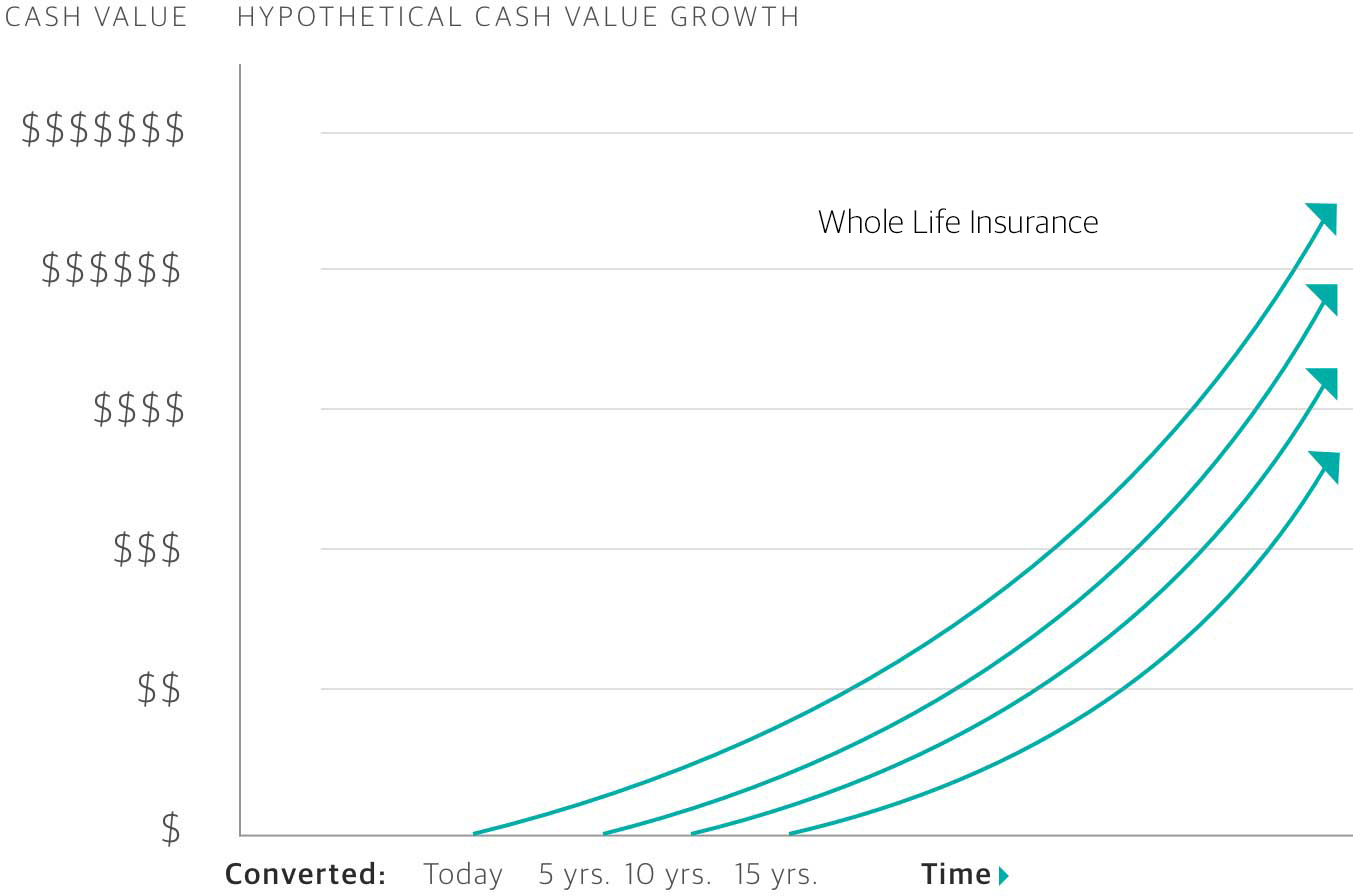

This provides a guaranteed cash value. Whole life has low returns when held for decades. Switching to a policy that provides coverage only if you die within a designated time frame such as a.

You may also be able to cancel your policy and. The insurer often pulls your medical records, requests. The answer to the question can you cash out a life insurance policy is yes.

That means that, after a while, the returns going forward may not. Here are ways to access some or all of the cash in a permanent life insurance policy: The cash value acts as collateral, allowing you.

To complete the whole life insurance buying process, you typically need to go through medical underwriting. Whole life insurance is a contract with premiums that includes insurance and investment components. Whole life insurance policy:

Start by getting a free life insurance price estimate here to learn more. Calculate the cost of whole life insurance 2. Whole life insurance was a popular form of life insurance cover in australia during the 1970s and 1980s.

Nerdwallet’s life insurance ratings are based on consumer experience, complaint index scores from the national association of insurance commissioners for. Basic or level term plan. Withdraw part of the cash.

But some insurers give you the option to pay your premium in full upfront, or over 10, 15 or 20 years. Policy factors that influence the cost of whole life insurance 3. Well, we can’t recommend a good divorce lawyer, but we can answer your question about how to cancel a whole life insurance policy and help make sure you’re.

This type of plan has a fixed sum assured which. How does cash value accumulate in whole life insurance? Unlike term life, these policies earn cash.

Keep your whole life insurance policy if you've had it for a long time. Cash value life insurance can be one of the most convenient,. Boost the death benefit if you have accumulated sizable cash value over the life of your permanent life insurance policy and do not intend to use.

![How To Get Life Insurance With Multiple Sclerosis [2023]](https://www.quickquote.com/wp-content/uploads/2020/10/f45dc55e-what_happens_with_no_life_insurance.png)

![Whole Life Insurance Dividend Rates History [Dec 2023 Update] Get A Quote](https://topwholelife.com/wp-content/uploads/2022/12/Whole-Life-Dividend-History-2023.png)