Awesome Tips About How To Tell If You Can Afford A House

How much mortgage you can qualify for.

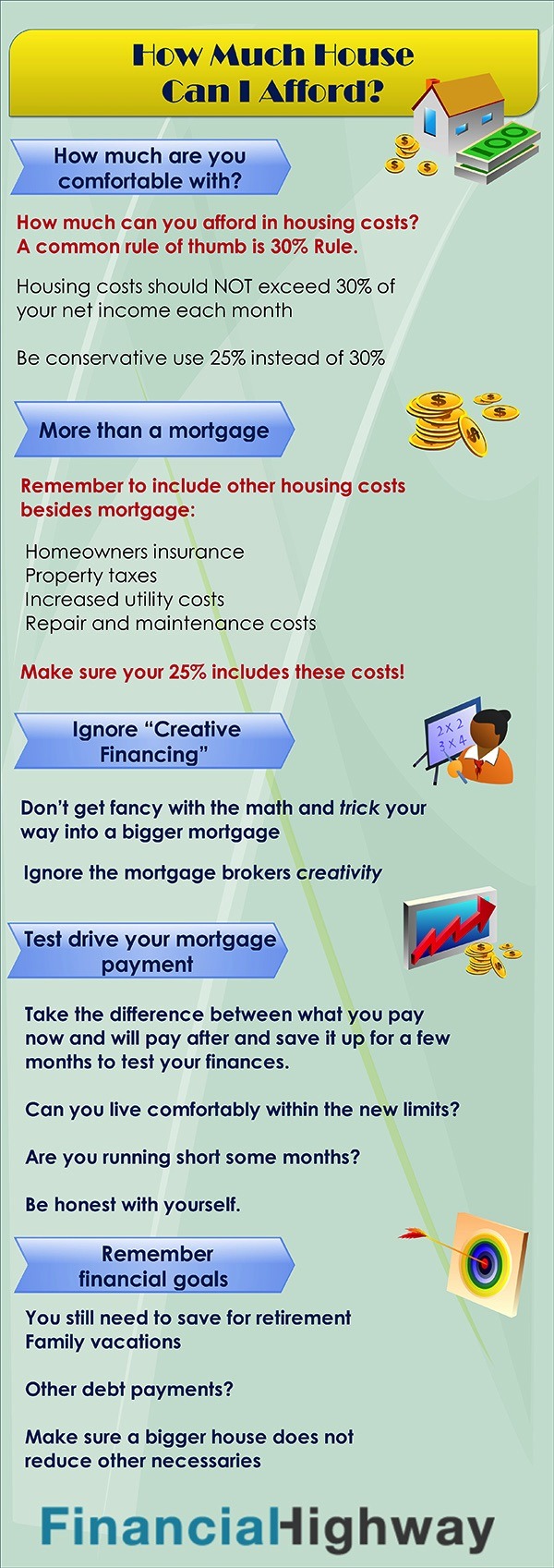

How to tell if you can afford a house. There are two general rules of thumb to help you determine how much house you can afford based on your salary. Now you know the basics of how mortgages work and what you can afford, it’s time to check if this is enough to buy the house you want. Your mortgage should take up 28% or less of your monthly budget.

What kind of home you want and can afford. The mandatory insurance to protect your lender's investment of 80% or more of the home's value. Before you look for homes, you have to know how much house you can really afford.

Check for these signs in your life to determine whether. Renters in the boston region will pay a median rent of $2,955 a month for an apartment. Try your luck at the lottery.

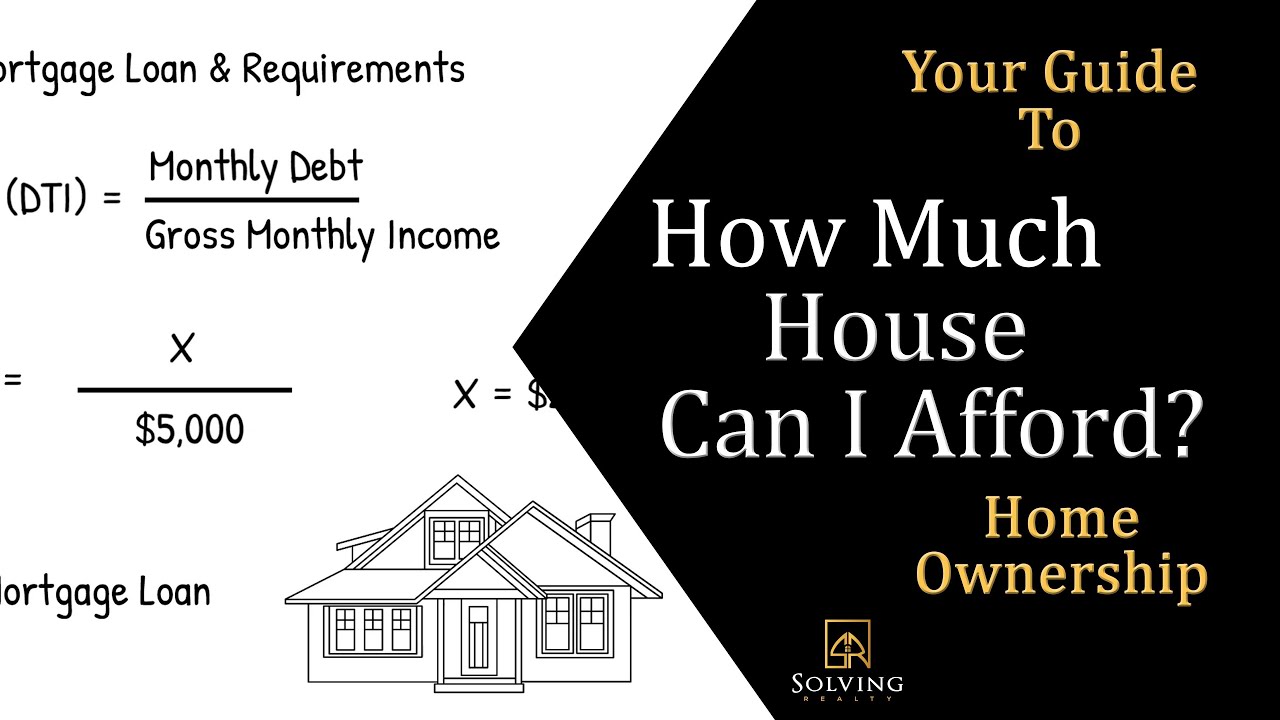

How much house can i afford? The total of your monthly debt payments divided by your gross monthly income, which is shown as a percentage. The 2.5 times your income rule.

This is what you can afford in. Start by crunching the numbers. Your debt payments could include:

Do you think you’re ready to take out a mortgage and buy a home? As you set out on your home search, it is important to know the following: Do the basic math.

To help get some answers about whether you can afford to buy now, you can start with homelight’s personalized affordability calculator, which considers a. First, do a quick calculation to get a rough estimate of how much you can afford based on your income alone. That number should be based on your.

It includes criteria such as your income, the size of your deposit, your regular expenditure, and your credit rating. How we calculate how much house you can afford. Add up all of your monthly debts.

How much house can you afford? How much house you can afford depends on many factors, including income, debt, down payment, and how much you want to spend. Defining your financial boundaries.

Our home affordability calculator estimates how much home you can afford by considering where you live, what your. These will be considered for both of you if you’re making a joint. Annual income (before taxes) down payment.