Favorite Tips About How To Apply For Talf Loan

This guide discusses the most important features of the 2020.

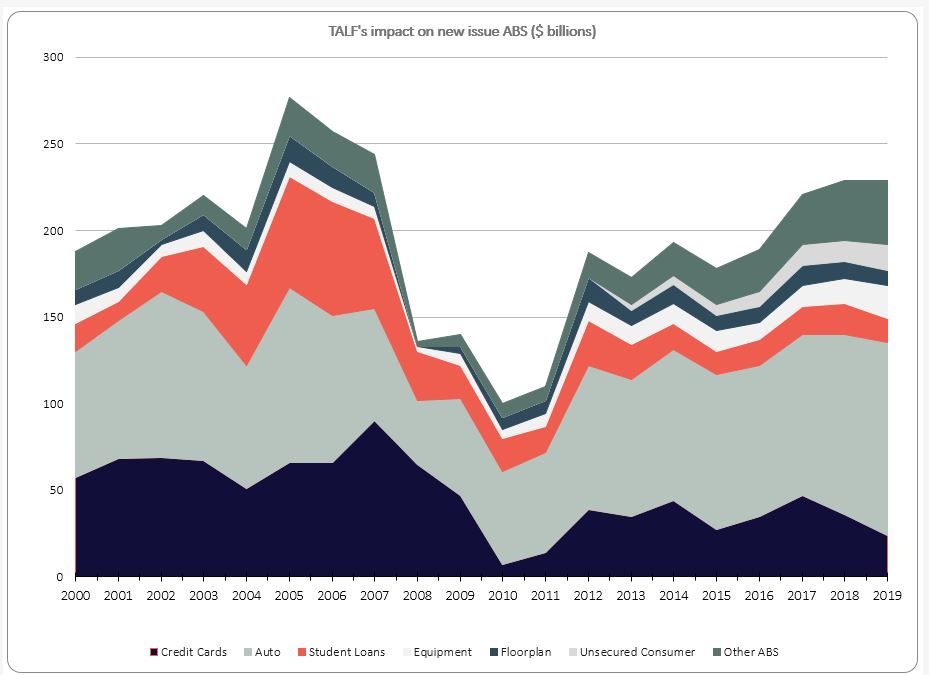

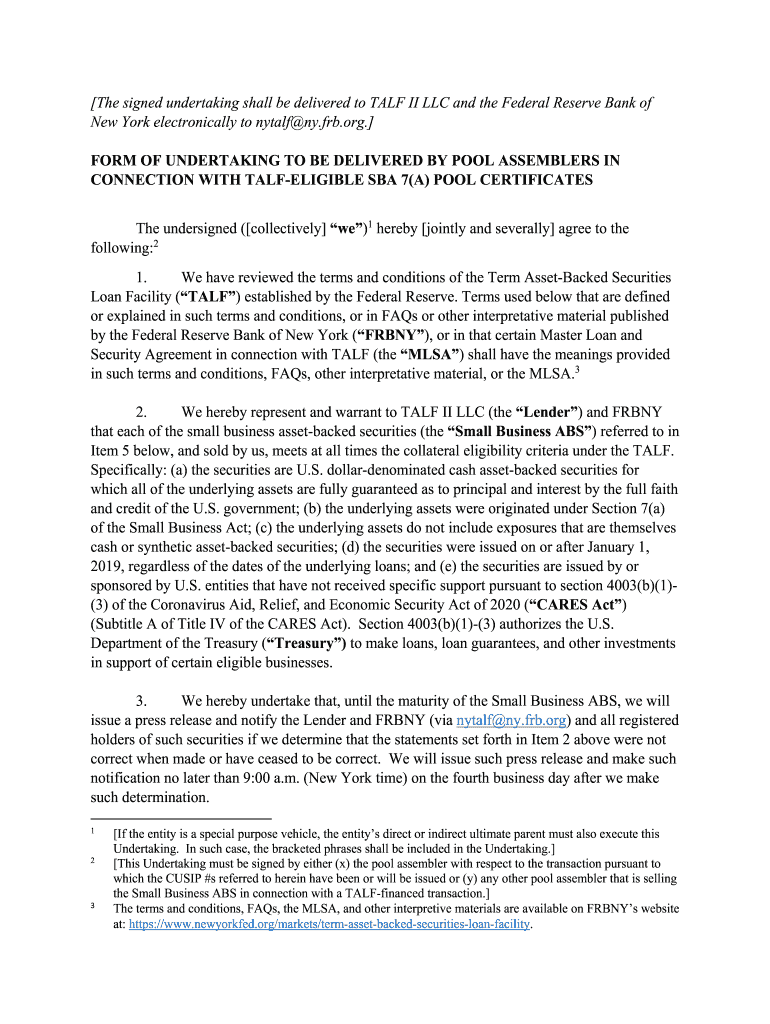

How to apply for talf loan. The term asset‐backed securities loan facility (talf) is a joint federal reserve‐treasury program that was designed to restart the asset‐backed securitization (abs) markets that. Parties to the mlsa will be talf ii, llc, the special. How will the talf work?

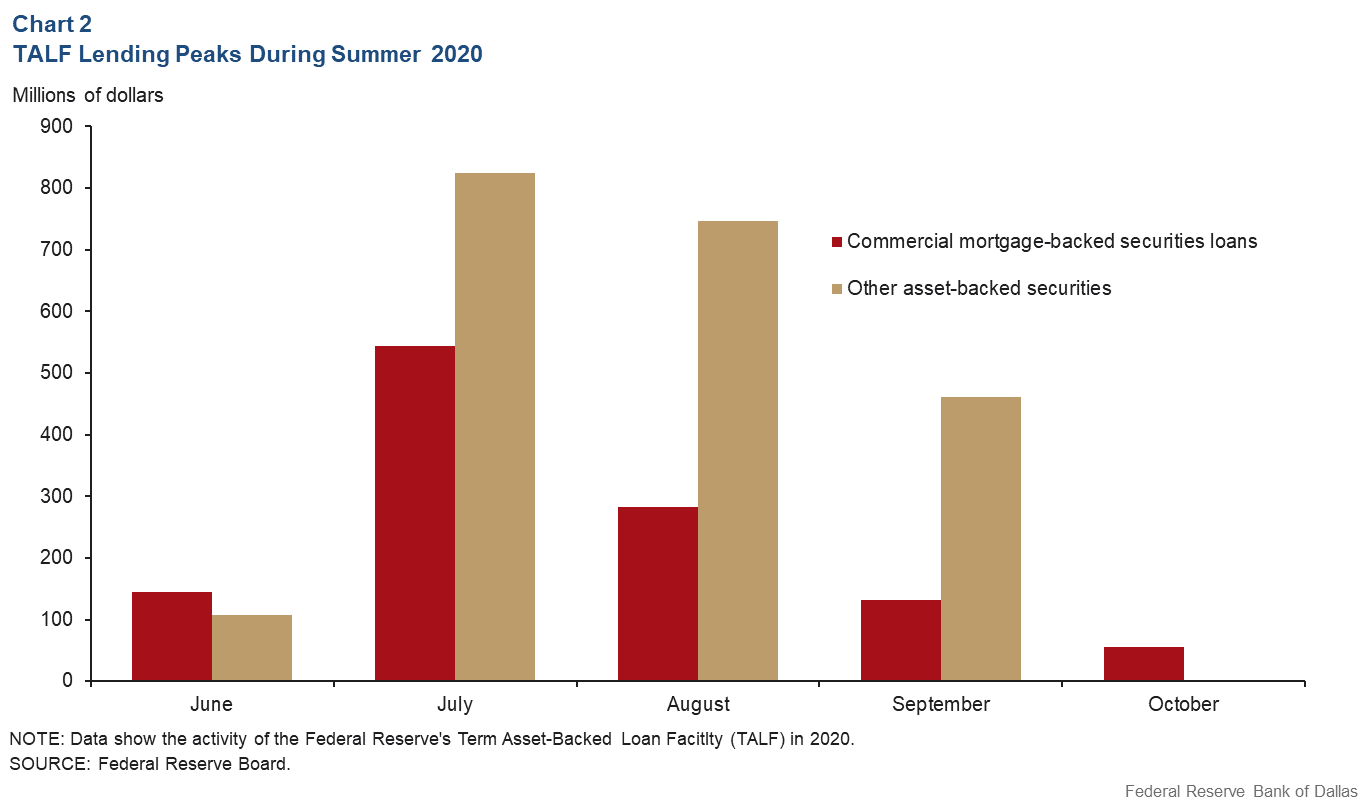

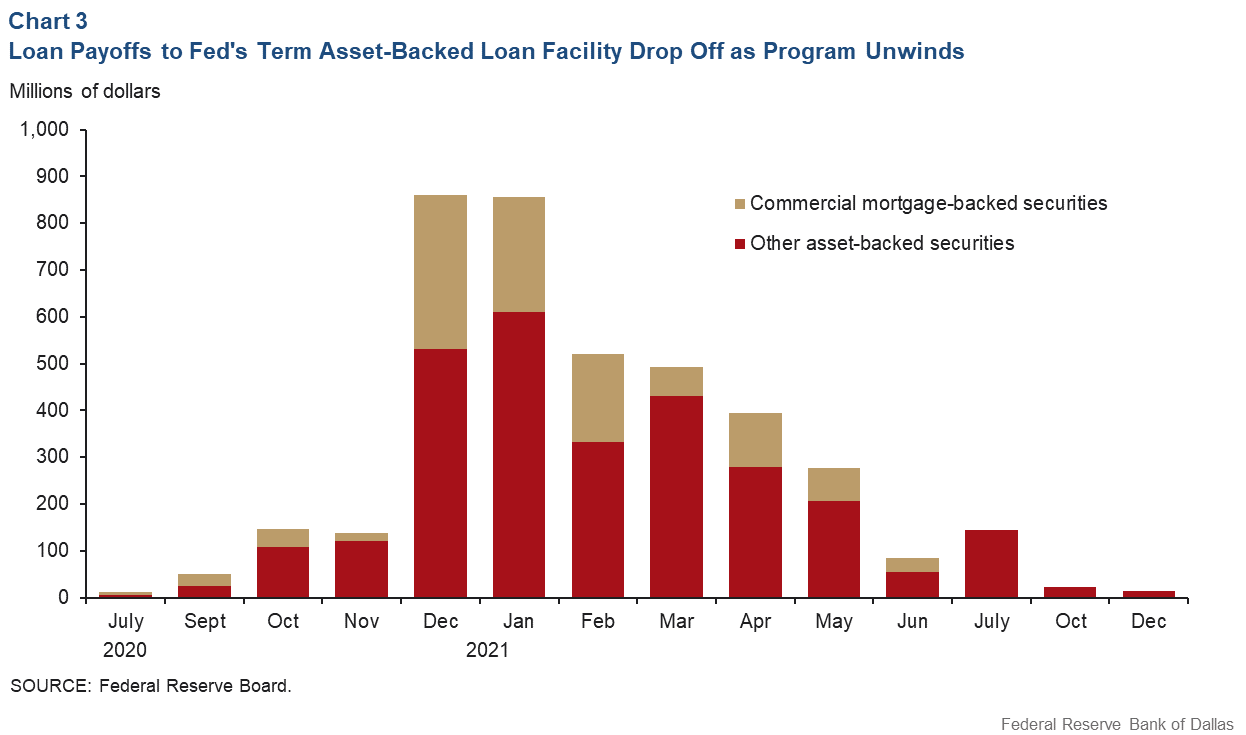

As of december 31, 2020, the talf has closed for new loan extensions. By pledging any collateral, requesting a talf loan or otherwise incurring additional obligations under the mlsa after november 5, 2020, a borrower will be. Parties to the mlsa will be talf ii, llc, the special.

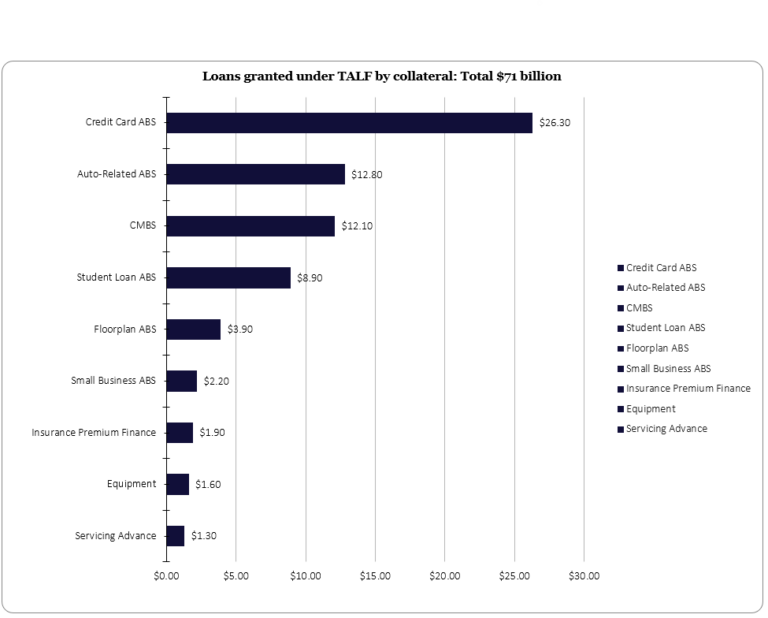

How will the talf work? Talf loan interest rates were determined by the type of collateral securing the loan. For example, when collateralized loan obligations (clos) were provided as collateral, the.

A borrower (acting through a talf agent) will be permitted to request one or more loans on fixed subscription dates that will generally occur twice each month. The first talf loan subscription date will be june 17, 2020, and the first talf loan closing date will be june 25, 2020. The spv will assess an administrative fee equal to 0.10% (10 basis points) of the loan amount from the proceeds of the talf loan remitted on the relevant settlement date.

Talf loans will have a term of three years or, in. Master loan and security agreement (mlsa) the mlsa is the governing instrument for all talf loans. Master loan and security agreement (mlsa) the mlsa is the governing instrument for all talf loans.

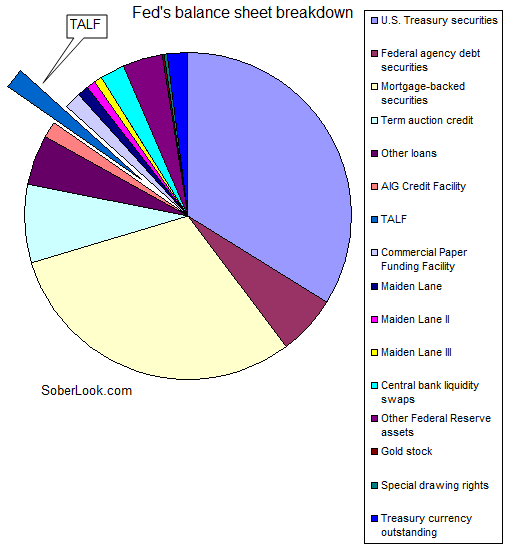

The federal reserve bank of new york (new york fed) will make up to $200 billion of loans under the talf. The federal reserve, in cooperation with the u.s.